Introduction:

YavaBook stands out in the crowded accounting software market for its simplicity, functionality, and affordability—it’s completely free. Ideal for small businesses and startups, it offers tools for invoicing, expense tracking, and reporting. As the demand for cost-effective solutions grows in 2025, YavaBook continues to be a trusted choice for entrepreneurs.

What Makes YavaBook Unique?

Completely Free

Unlike other platforms that offer limited free plans or hidden fees, YavaBook provides a full suite of accounting tools without any cost.Tailored for Small Businesses

Designed with the unique needs of startups and small businesses in mind, YavaBook combines simplicity with powerful features.GST Compliance

YavaBook is ideal for businesses in Singapore, offering GST-ready invoicing and reporting.Cloud-Based Convenience

Manage your finances from anywhere with secure, cloud-based access.

For more insights into its features, see How YavaBook Fits into the Interior Design Workflow.

Key Features of YavaBook

1. GST-Ready Invoicing

Generate professional invoices with automated GST calculations.

Send reminders for overdue payments to improve cash flow.

2. Automated Expense Tracking

Sync your bank accounts to automatically track and categorize expenses.

Monitor spending patterns with real-time dashboards.

3. Real-Time Reporting

Access profit and loss statements, cash flow summaries, and balance sheets.

Make data-driven decisions with up-to-date financial insights.

4. Tax Compliance Tools

Prepare tax-ready reports to simplify filings and avoid penalties.

5. User-Friendly Interface

Intuitive design makes it easy for non-accountants to navigate and use.

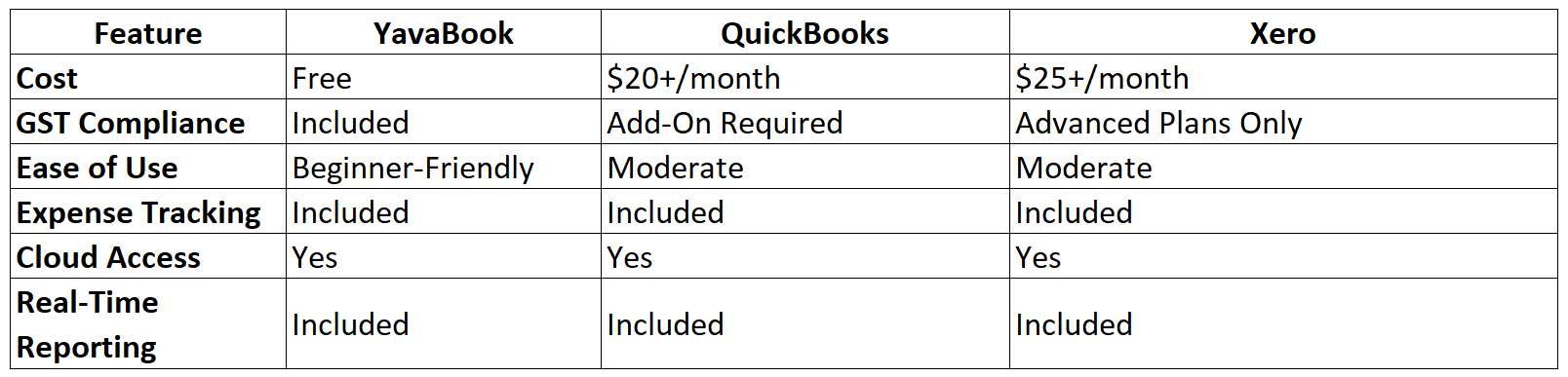

Comparison: YavaBook vs Paid Alternatives

For a deeper comparison, check out Xero Accounting vs Free Alternatives: Are Paid Tools Worth It?.

Benefits of Using YavaBook

1. Cost Savings

Eliminate subscription fees and reinvest savings into other areas of your business.

2. Simplified Bookkeeping

Automate key processes like invoicing and expense tracking to save time and reduce errors.

3. Tax Compliance

Ensure accuracy and compliance with GST-ready tools, reducing the risk of penalties.

4. Scalability

As your business grows, YavaBook adapts to handle more complex accounting needs.

How to Get Started with YavaBook

Sign Up for Free

Visit the YavaBook website and create an account.Set Up Your Profile

Add your business name, logo, and tax information.

Configure your GST preferences.

Import Data

Migrate existing financial records for a seamless transition.

Link your bank accounts to automate transactions.

Start Managing Finances

Automate invoices, track expenses, and generate real-time reports.

For step-by-step guidance, see Step-by-Step Guide to Getting Started with YavaBook’s Free Accounting Software.

Real-Life Example: A Business Success Story

A Singaporean marketing agency switched to YavaBook after struggling with manual bookkeeping. Within three months, they:

Automated invoicing, reducing overdue payments by 35%.

Gained real-time insights into cash flow, improving financial planning.

Avoided over $300 in annual subscription fees compared to paid tools.

For similar success stories, explore Small Business Accounting Software: A Game-Changer for Entrepreneurs.

Tips for Maximizing YavaBook

Leverage Automation

Use recurring invoices and automated expense tracking to save time.Regularly Review Financial Reports

Monitor key metrics like cash flow and profit margins to identify areas for improvement.Engage with Support Resources

Access tutorials and FAQs to fully understand the software’s capabilities.

Conclusion

YavaBook offers an unbeatable combination of powerful features, ease of use, and cost-free access, making it the best free accounting software for 2025. Whether you’re a startup or a growing SME, YavaBook provides everything you need to manage your finances efficiently and focus on scaling your business.

Ready to experience the difference? Sign up for YavaBook today and discover how free accounting software can revolutionize your business.

Article by

Webb Poh

CEO and Founder

Published on

Nov 1, 2024