Introduction:

Small businesses face tight budgets and limited time. Free accounting software like YavaBook helps by:

1) Reducing costs,

2) Saving time with automation,

3) Improving accuracy,

4) Providing easy access to financial data, and

5) Supporting growth with scalable features.

Get started with YavaBook today!

1. Cost Savings

For small businesses with tight budgets, every dollar counts. Free accounting software eliminates the need for subscription fees, offering essential tools without financial strain.

Key Benefits:

Save hundreds of dollars annually compared to paid options like QuickBooks or Xero.

Allocate resources toward business growth, such as marketing or hiring.

Example: A Singaporean cafe saved over $300 annually by switching from paid software to YavaBook, which provided all the features they needed for free.

For more cost-saving strategies, explore How Free Accounting Software Can Save Your Small Business Time and Money.

2. Simplified Bookkeeping

Manual bookkeeping can be time-consuming and prone to errors. Free accounting software automates key tasks, allowing businesses to focus on growth.

Key Features:

Automatic expense categorization and bank reconciliation.

Easy-to-generate profit and loss statements.

Example: A retail business used YavaBook’s automated tracking to reduce bookkeeping errors by 40%.

3. Improved Cash Flow Management

Maintaining a healthy cash flow is essential for business survival. Free accounting software helps track income, expenses, and payment due dates in real time.

Key Features:

Real-time dashboards for cash flow monitoring.

Automated reminders for overdue invoices.

Example: A design agency improved their cash flow by 30% using YavaBook’s invoicing tools to send timely payment reminders.

4. Tax Compliance Made Easy

Tax filing can be complicated, especially for businesses with limited financial expertise. Free accounting software simplifies compliance with automated tools and ready-to-use reports.

Key Features:

GST-ready invoicing and reporting for Singaporean businesses.

Built-in tax calculation tools to minimize errors.

For detailed on non-profit solutions, see Top Free Accounting Software Options for Non-profits in 2025.

5. Accessibility and Scalability

Modern free accounting tools are cloud-based, making them accessible from anywhere. They also offer features that scale with business growth, ensuring long-term usability.

Key Features:

Access financial data on any device with an internet connection.

Add users or upgrade tools as your business grows.

Example: A small e-commerce business expanded internationally while continuing to use YavaBook, leveraging its scalable features and multi-user capabilities.

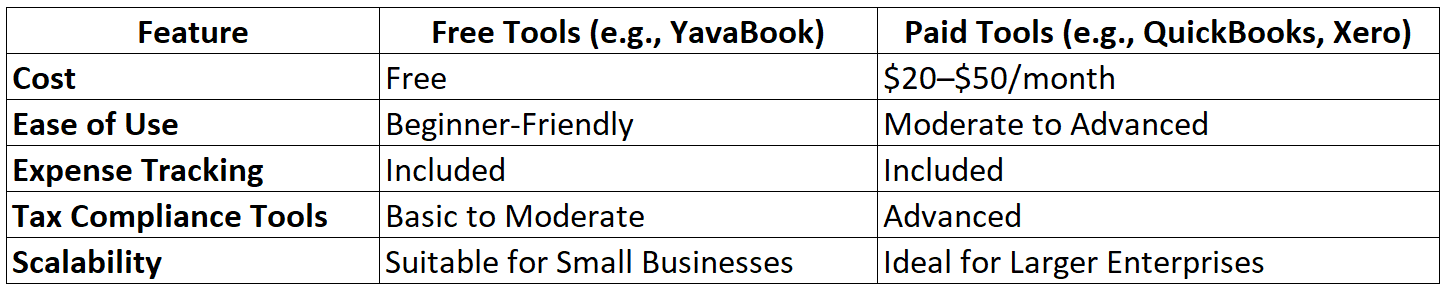

Comparison: Free vs. Paid Accounting Software

For a detailed comparison, read QuickBooks Online vs QuickBooks Desktop: Which is Best for Your Business?.

Tips for Maximizing Free Accounting Software

Choose the Right Platform

Select a tool like YavaBook that aligns with your business’s needs, such as invoicing or tax compliance.Leverage Automation

Use features like automated reminders and expense tracking to save time and reduce errors.Regularly Review Financial Data

Analyze reports monthly to identify areas for improvement in your cash flow or spending.

For step-by-step guidance, check out How to Download and Set Up Free Accounting Software in 5 Easy Steps.

Real-Life Success Story: A Small Business Saves with YavaBook

A Singaporean consultancy firm switched to YavaBook to manage their finances. They:

Automated their bookkeeping, saving hours each week.

Reduced tax filing errors with GST-ready reports.

Avoided subscription fees, saving $360 annually.

For similar stories, explore The Benefits of Online Accounting Degrees for Entrepreneurs.

Conclusion

Free accounting software is an invaluable tool for small businesses, offering cost savings, automation, and simplified tax compliance. Platforms like YavaBook provide robust features tailored to small business needs, making financial management easier and more efficient.

Ready to simplify your accounting? Sign up for YavaBook today and take control of your business finances without spending a dime.

Article by

Webb Poh

CEO and Founder

Published on

Aug 17, 2024